Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

What are countries doing to implement OECD's BEPS Pillar 2.0? What are countries doing to implement OECD's BEPS Pillar 2.0?

BEPS: what's next?. The final OECD package to tackle… | by Pierre Habbard | Workers Voice @ OECD | Medium

OECD Releases Strategy for Deepening Developing Country Engagement For BEPS « William Byrnes' Tax, Wealth, and Risk Intelligence

A look at the commitment of the countries of Latin America and the Caribbean to combat the tax base erosion and profit shifting | Inter-American Center of Tax Administrations

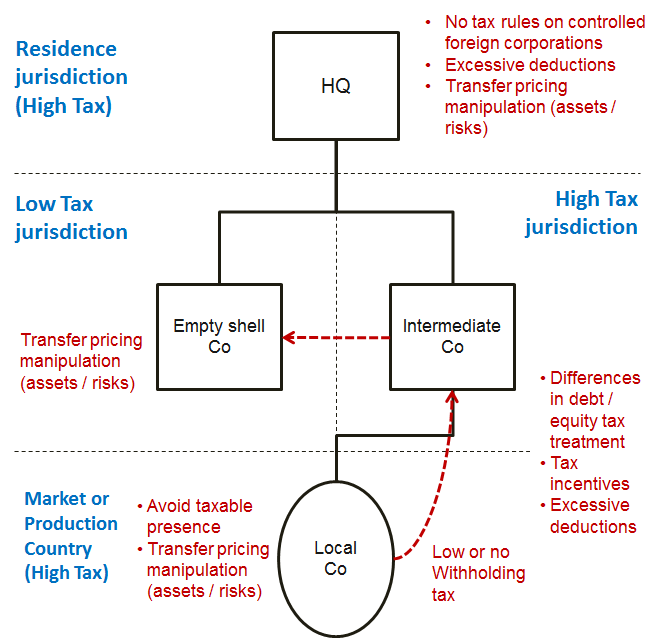

For the Record : Newsletter from Andersen : May 2015 : Addressing International Tax Planning in the Changing BEPS Landscape

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

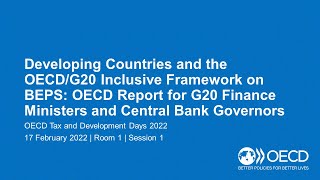

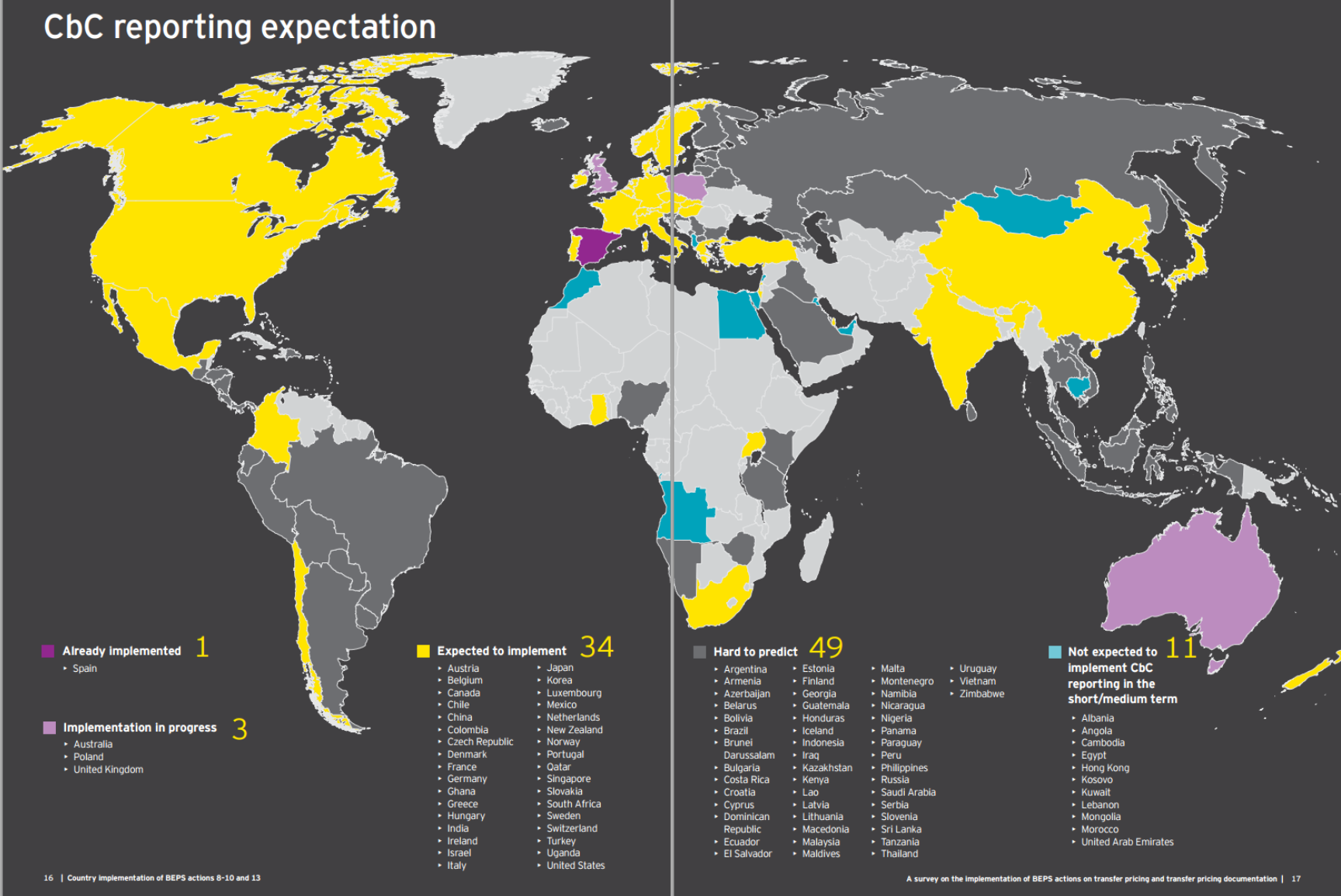

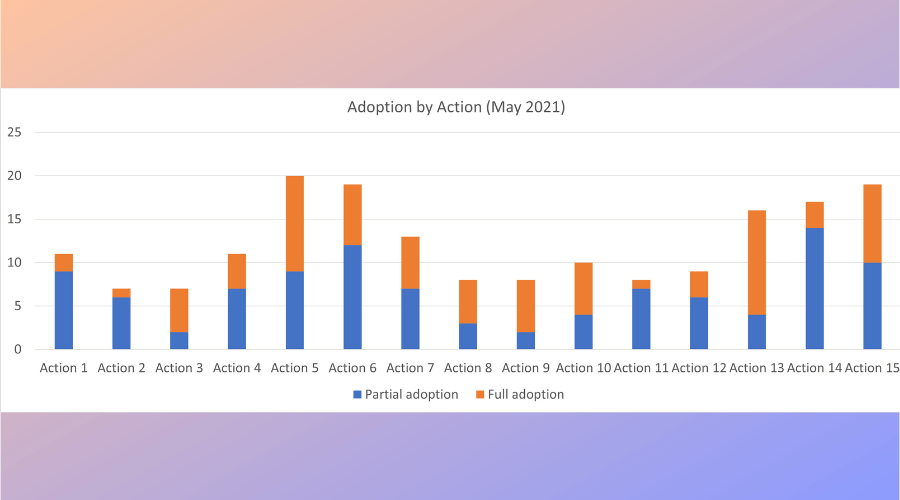

disseminates updated information on the adoption of BEPS recommendations in its member countries as of May 2021 | Inter-American Center of Tax Administrations

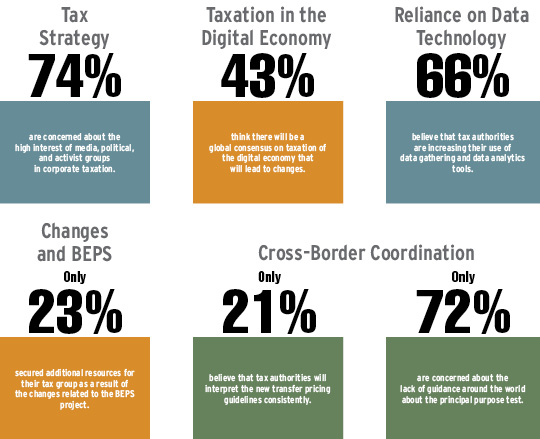

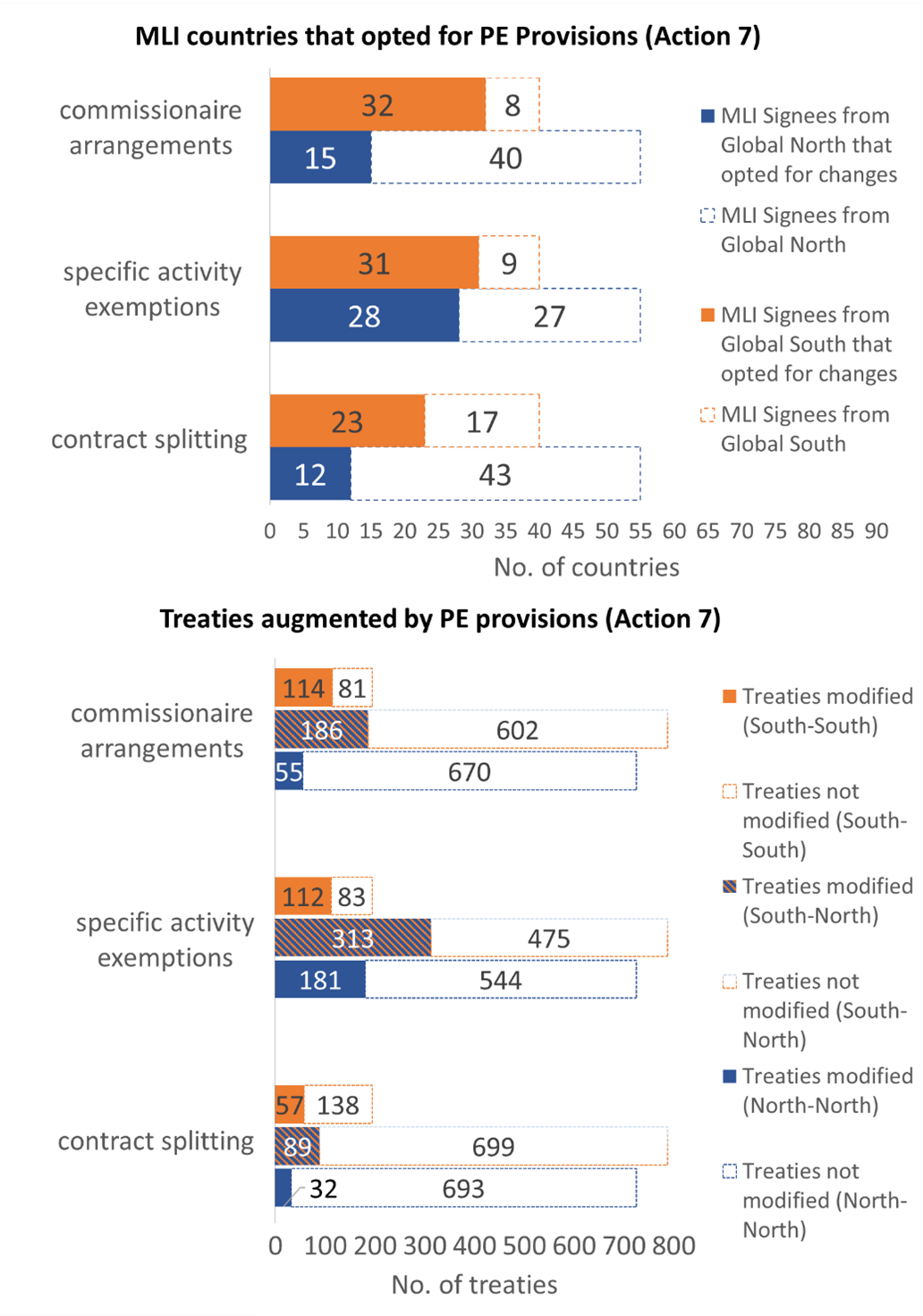

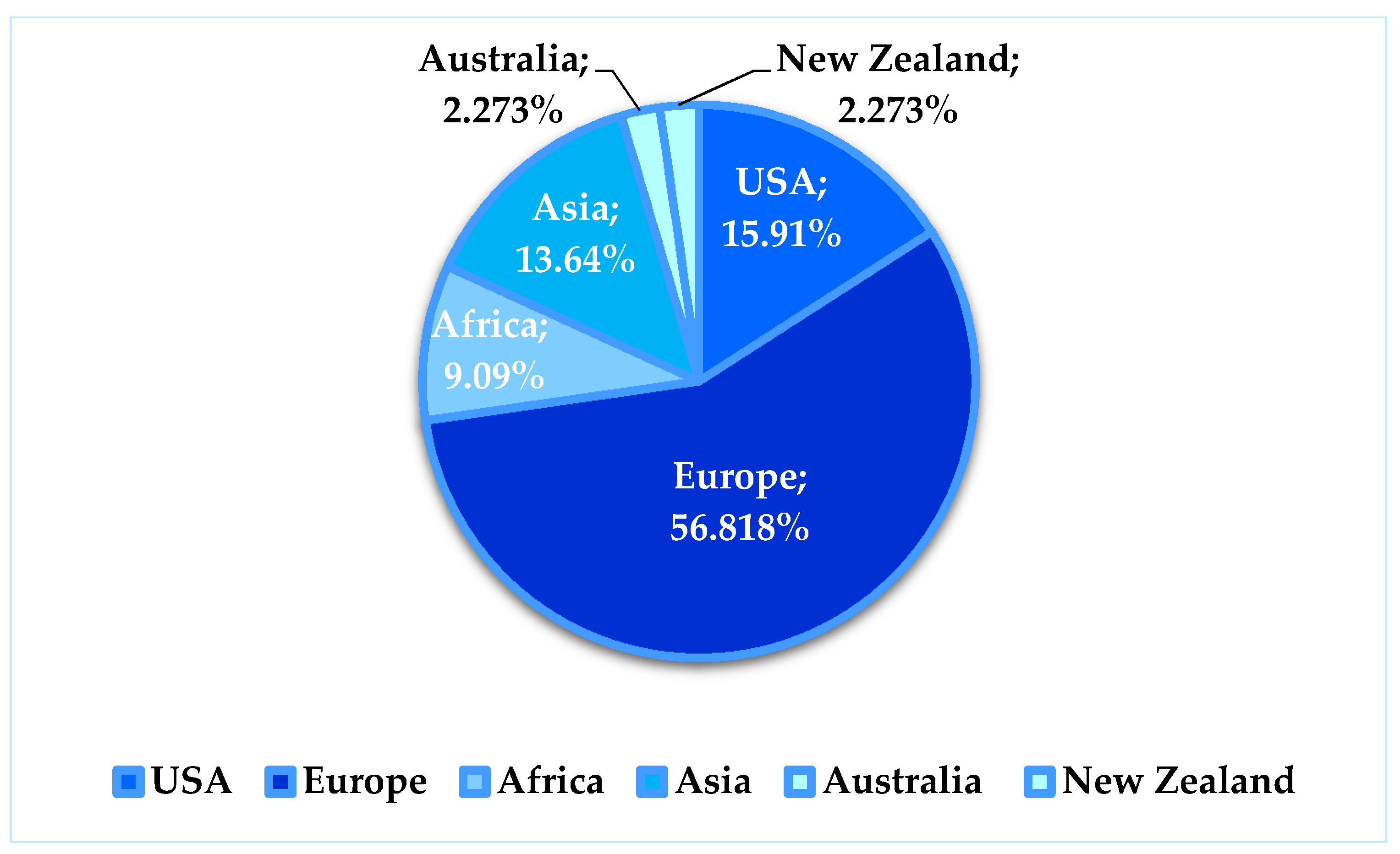

BEPS Actions and Approaches to Their Implementation at the Country Level | Download Scientific Diagram

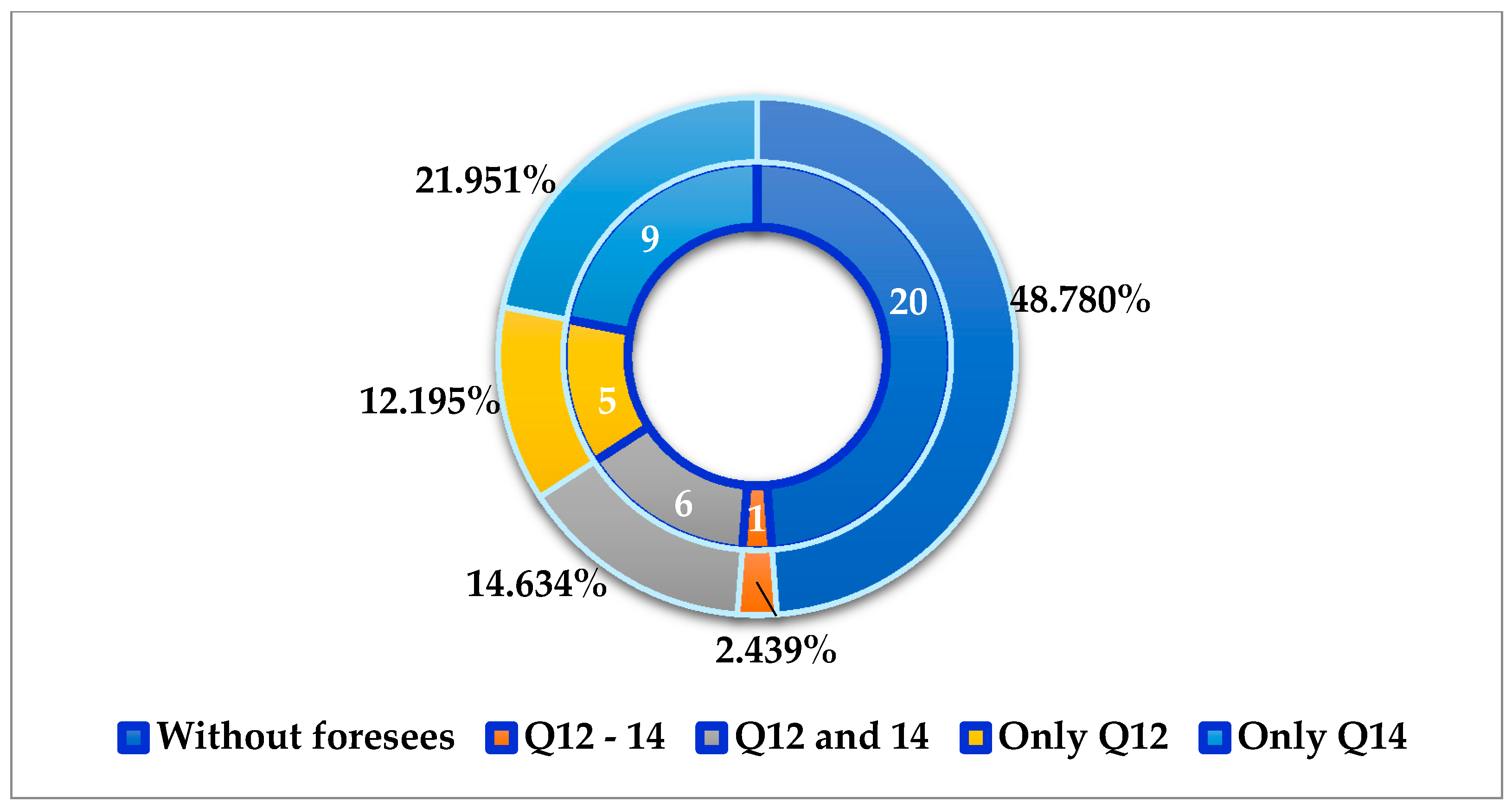

2 General adoption of each BEPS action by 29 LAC CIAT member countries... | Download Scientific Diagram